Assignment Roadmap to International Business (IB) Case Study Analysis Answers for Investigating Nedbank

Do You Need International Business Assignment Answers? AssignmentTask.com has a team of more than MBA/PhD expert writers that make future of million students from Australia. Be it your Online Assignment Help, Best Case Study Help or Assignment Writing Services Australia, AssignmentTask.com is the one-stop solution for all.

Assignment Roadmap

No. of Words: 5000

Module: International Business (IB)

Topic: Investigating Nedbank’s internationalisation into Egypt

Executive Summary (~ 500 words)

Write this up last – once you have completed your full assignment.

Provide a concise summary of:

- Introduction (business intro, context)

- Key issue (why the business is considering internationalisation)

- Brief discussion of analytical approach taken (what did you analyse and how)

- Key insights from the four levels of analysis (i.e. macro, market, competitors, internal)

- Options derived in terms of internationalisation (“where” and “how”)

- Summary of final decision/recommendation, including both the “where” and “how”

- Summary of the key implications and next steps

Typically, each bullet point above will translate into a paragraph in your executive summary, bar the analysis point, which may require more.

Extra – Have a read through this article, which discusses the executive summary in more depth:

https://grad.coach/how-to-write-an-executive-summary/

Chapter 1: Introduction (750 – 900 words)

You will need to cover the following:

- Provide a brief introduction to Nedbank’s operations – what does it do (in layman’s terms), where does it operate, how long has it been in business, who is its customers, what are its business objectives and basic strategy (i.e. its plan to achieve its objectives).

- Explain any relevant terminology and/or jargon regarding the product offering.

- Explain the context, which leads to the opportunity and justifies the focus of the assignment: o what context has led Nedbank to want to consider internationalisation (or further internationalisation)?

- There are various push and pull factors that might drive a firm to consider going abroad – for example, an increasingly competitive local landscape, local economic uncertainty or decline, etc. Consider some of the “push and pull” factors as per the IB theory and make a clear argument as to why Nedbank would entertain going abroad as opposed to just focusing their efforts on gaining more market share at home (SA). I have included the relevant “push and pull factors” model on the next page for your easy reference.

Which market/s (country/ies) is it interested in and why?

Explain why Country X, in particular, is on the shortlist (or if you choose to analyse two markets, why they are both on the shortlist).

You don’t need to go into much detail here, but there’s needs to be some brief explanation as to why you’d consider venturing into this country.

- Simply put, this section is about providing a justification for the investigation. Make it clear why this topic is important to the business (i.e. what is its logic for internationalisation?) and why you’re assessing Country X specifically.

- Present the research questions (RQs), namely: o RQ1: Should Nedbank consider internationalisation into Country X (and/or another country)?

RQ2: If so, which entry mode would be most appropriate?

- Outline your theoretical approach to the analysis – a brief overview of what models and frameworks you used, in what order (we’ll cover this in the next section). Do this right at the end of the writing process.

- Briefly discuss your approach to the fieldwork – what information sources did you use? For example, informal interviews, industry reports, company-provided data, etc.

- Mention your relationship to the organisation (if you haven’t already) and how you’re involved in this specific challenge, if at all.

Below: the push and pull factors for internationalisation (for discussion in your context section)

Extra – You might find the following post useful for guidance on how to write a strong introduction chapter:

https://grad.coach/introduction-essentials/

Chapter 2: Analysis (2000 – 2400 words):

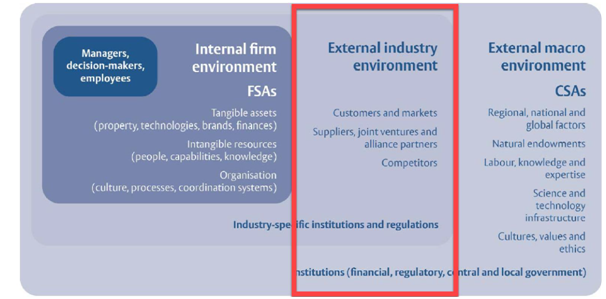

The analysis chapter can be approached using Collinson et al’s (2017) “international business environment” model (see below) as a guiding structure, flowing from right to left.

In other words, your analysis should cover four main areas:

- Macro-level / institution-based analysis (CSAs) – is Country X itself attractive in terms of the institutional environment it offers to businesses? E.g. laws, ease of business, etc.

- Meso-level (industry):

(a) Market analysis – is there an attractive local market in Country X that will be interested in your offering (market size and receptiveness)?

(b) Competitor analysis – how competitive is the local playing field and is there a gap that you can fill (an opportunity to differentiate yourself)?

- Internal-level analysis (FSAs) – do you have the resources and capabilities to overcome the liability of foreignness (LoF) that you will face? Can you provide a differentiated offering?

In terms of order, it’s always best to have your analysis flow from macro to meso to micro (internal), so I suggest ordering your analysis as presented above.

2.1 – Macro-level / institution-based analysis (CSAs)

This section will look at the “big picture” of Country X to assess the general attractiveness of doing business there and how big a leap this is from doing business in your home country (i.e. your liability of foreignness). In other words, the key questions here are:

- How attractive is the institutional environment?

- What are the key risks, challenges and contributors to liability of foreignness (LoF)?

Keep in mind that the focus at this stage is on Country X as a country itself, not the customer market or competitive environment within that country (these will come in the next section). However, you should still be making links between these levels, as the macro typically impacts the meso. Moreover, given that your internal analysis only takes place later, your macro-level analysis should be taking a generic perspective, not a firm-specific perspective. In other words, how appealing if the institutional environment for any new entrant or competitor in your industry?

The PESTLE framework works well here to investigate the macro aspects of the host country. Don’t bother trying to fit it in a table – rather discuss in body copy. It is also prudent to integrate/blend PESTLE with Ghemawat’s CAGE framework to enrich the analysis and draw comparisons between home and host country. There is a lot of overlap between these two models, so they integrate well together – see table below which highlights the overlaps.

have sourced a few macro-level country reports for Egypt and Algeria. Quality reports for Sudan were impossible to come by, so I’d suggest focusing on Egypt and/or Algeria, unless you have macro-level data for Sudan.

You can also do some Googles searches for “Country X PESTLE”, “Country X country report”, etc. Make sure you search for recent reports (late 2019/ early 2020), as this information needs to be fresh. I can assist if you have trouble finding these reports (the ARC is not very user-friendly) – let me know.

For economic data, you can use World Bank, World Economic Forum and CIA Factbook data (all easy to find on Google) to source this info. All of this is freely available online – just search on Google. See, for example:

- https://tradingeconomics.com/egypt/indicators

- https://data.worldbank.org/country/egypt-arab-rep

You can also use the CAGE comparator (https://ghemawat.com/cage) to get a CAGE comparison between the countries.

I’ve included some thought-starters for your PESTLE/CAGE analysis below. You don’t need to cover every point – just focus on that which is most relevant to the overall research questions.

Political & legal:

- Extent and efficiency of government bureaucracy – how easy is it to set up a business in the country? See http://www.doingbusiness.org/rankings

- Taxation laws – how attractive is the tax system? Are there any incentives for foreign investors in your industry? Consider both corporate and income tax, as the latter impacts the cost of labour.

- Foreign ownership laws – are foreign persons or entities allowed to own companies? What restrictions exist? Are there any exemptions?

- Profit repatriation – are companies allowed to repatriate profits to their home countries? What limits and complexities exist.

- Regulation – how regulated is the industry at hand? Is this regulation attractive or are you ill-equipped to work with it?

- Labour laws – how attractive are the labour laws for employers? Do they allow for easy import of foreign talent (this will likely be important when starting up)?

- Law and enforcement – Is the legal system based on common law? How effective is it? Is intellectual property protected?

- Corruption – see data at https://www.transparency.org/country

Economic:

- Look at some basic top-level country economic information for Country X over a 3-5-year period, including population, GDP, GDP growth, FDI, GDP per capita, etc. What does this tell you about the general state of business?

- Consider economic integrations/unions and the impact that this has on country attractiveness.

- Then, give some thought to the economic factors that impact your running a business in Country X, for example: o Availability and cost of corporate credit – how easy is it to raise debt financing? Same for equity?

- Currency stability – how stable is the local currency, are companies allowed to trade in a more stable base, or can they hedge to reduce their exposure to volatility? How about exchange control restrictions?

- Comparative wage rates – how affordable is quality labour? Try find industry-specific data on PayScale, GlassDoor, etc and compare to costs in the home country.

- Comparative office space rates – how affordable is work space?

Socio-demographic:

- Consider how socio-demographic metrics impact the local workforce, which you will likely need to employ. I.e. will you be able to find the skills you need, at the right price? o Education levels and industry-specific skills

- Native languages and prevalence of English

- Work ethic; quality of work life

- Crime, theft and security

- Culture – this one impacts both staffing and customers. What are the key differences and how substantial are they? You can use Hofstede’s data for this – see https://www.hofstede-insights.com/product/compare-countries/

Technological:

- Are there any technology compatibility considerations that may create challenges (or opportunities)?

- Does the host country have the technology needed/support infrastructure for your industry?

Environmental:

- Environmental issues that may count against you or aid you (e.g. “green” legislation or incentives, public stance/expectations re environmental issues, etc).

- Practical differences that impact the ease of doing business: o Differences in time zones

- Physical distance and travel time from the home country

- Quality and accessibility of airports

- Terrorism threats

Important – When writing up this section, it is very easy to slip into the trap of descriptive writing, as opposed to analytical writing. In other words, you present a whole lot of data, facts and figures, but fail to discuss what the impact of these points are. Your analysis doesn’t connect back to the research questions. To avoid this, make sure that for each section of writing, you make it clear whether the data, facts or figures:

- Increase or decrease the institutional attractiveness

- Present a potential liability of foreignness

- Impact potential entry mode options (for example, if 100% foreign ownership is not allowed)

If you consistently link the discussion back to these three considerations, you’ll have a rich analysis. For more information on analytical writing, see https://grad.coach/analyse-dont-describe/.

Round off the macro-level analysis with a brief concluding summary. Importantly, this summary should make it clear:

- How attractive is the country from an institutional perspective?

- What are the key differences between your home market/country and Country X? In other words, what are the contributors to your “liability of foreignness”.

2.2 Customer/market analysis (demand-side analysis)

Now that you’ve assessed the institutional environment in terms of its attractiveness, it’s time to assess the industry-level environment (highlighted below).

The starting point is the demand-side/market side – i.e. what is the potential market for your specific offering? There are many aspects to consider, but the key questions to address are:

- How large and profitable (i.e. attractive) is the potential local market for your offering? How does this compare to the home country or other markets you’re involved in?

- How receptive are they likely to be to your offering? Do they need it (and know that they need it?) This will depend, in part, on the level of competitiveness (which you’ll assess in the next section).

- What are the potential barriers (liabilities of foreignness) you’ll face in terms of selling to this market?

There’s no specific model, framework or theory to apply in this section. You just need to present the information in a logical, digestible fashion. Supporting data in the form of charts/graphs demonstrating market trends can add a lot of value in this section.

- It would be good to present some information about:

- The size and growth rate of the market

- The lifecycle of the market (e.g. embryonic, growth, mature) and what that means in terms of future attractiveness (will it grow or decline?)

- Any PESTLE/CAGE-type factors that impact potential customer demand (for example, cultural differences that will impact how you sell, market, etc).

- Also consider the regional market access that being based in Country X might provide (i.e. neighbouring countries), given FTAs/unions/integrations in the region (which you would have touched on in the macro analysis).

As always, consider both the pros and cons – what aspects are attractive and what aspects will contribute towards your LoF? Oftentimes, cultural differences present a substantial LoF – don’t try downplay this. The more critical (balanced) the analysis, the better.

2.3 – Competitor/industry analysis (supply-side analysis)

Having considered the demand-side (customers), you need to analyse the supply-side (competitors) to identify the level of competition and competitive rivalry (and therefore profit potential), as well as any gaps/opportunities in the market which you can exploit.

It would be good to kick off with a basic overview of the industry. How established is the industry in Country X, how many comparable competitors are there, what’s the market structure? Then:

Porter’s 5 Forces Analysis:

You can use Porter’s 5 forces to assess the general attractiveness of the environment in Country X. How competitive is it, and what does this mean for potential profitability and attractiveness? How does this compare to the home country? Provide ratings for each of the forces and draw a conclusion about the overall level of competitive rivalry, and therefore attractiveness. Once you’ve done this, you can zoom into the competitive landscape by undertaking a competitor analysis.

Competitor Analysis:

You should also present some form of competitor analysis to understand who the comparable players in the market are, what their respective strengths (and weaknesses) are, and consequently, where an opportunity might lay for a new entrant to provide a differentiated offering.

Consider 3-4 comparable competitors that you would face in the host country – identify who they are and what their strengths and weaknesses are. Take note of what the competitor entry modes are – are they just “importing” their services into the country (i.e. based elsewhere and operating remotely), or do they have some sort of local physical presence, whether by JV, FDI, etc?

Importantly, in this section of the analysis you will need to identify a gap/competitive opportunity that you could potentially exploit. You can’t warrant going into a market if there are no identifiablegaps. Therefore, you must spend some time detailing what’s lacking in the market, and how this presents a gap for a new entrant.

Don’t get sucked into the trap of discussing your capabilities and how you can use these to exploit the gaps just yet. You will cover this in the internal/FSA analysis. For now, just focus on identifying opportunities/gaps.

Once that’s done, provide a brief concluding summary of the key insights – in particular:

- How attractive is the industry in terms of competitiveness (from the Porter analysis)?

- What opportunity(s) exist to provide a differentiated offering (from the comp analysis)?

2.4 – Resource-based (internal) analysis (FSAs)

Now that you’ve analysed the macro (institutional) and meso (supply and demand-side) environments, it’s (finally) time to look at your internal resources to assess whether they can provide you with any advantage in the new market, and potentially exploit the gaps/opportunities you identified in the previous section. In other words, the focus now moves to the innermost area of the model below:

Essentially, this section is about assessing whether your firm has what it takes to overcome the liability of foreignness it will face in Country X. This liability should be clear after the earlier analyses. Equally important, this section should identify whether you are able to exploit any of the gap(s) that exist in the market (which you identified in the competitor analysis).

Step 1 – Resource audit:

First, you’ll need to identify your resources – you can use Collinson et al’s (2017) “classes of FSAs” or any other resource identification framework to structure this section (see figure below). Here, you’ll need to briefly explain what each resource is in your case (justify its existence) – don’t just state that you have “good human capital” or “strong partnerships”.

Naturally, you don’t need to cover every possible resource and capability. Only discuss that which is relevant to the IB challenge at hand. If you have any potential partners, merger or acquisition prospects, you can mention this in the relational capital section.

I’d suggest using the following structure to discuss each of your resource/capabilities (or groups of resources/capabilities):

- What is the resource/capability? Be explicit.

- Does it help you reduce a liability of foreignness, exploit a market opportunity, or both? If so, how?

- Is it transferable to Country X, or is it restrained to the home country?

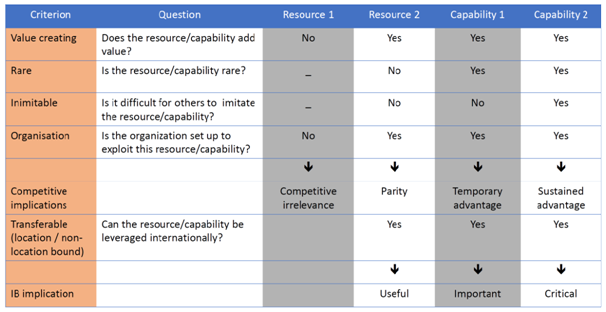

Step 2 – Resource evaluation:

Once you’ve identified the key resources, you need to evaluate them, in the context of the host country, Country X. You can use the VRIO(T) framework to assess whether they can provide any form of competitive advantage.

What’s important is that you take the perspective of the host country/market – not the home market. Resources and capabilities which provide a competitive advantage in your home country often won’t provide the same benefit in the host country, and vice versa (e.g. brand equity, customer relationships, supplier relationships, etc). Therefore, you can use the modified VRIO(T) framework to incorporate transferability as a criterion.

NB – you don’t need to score high marks all-round. The aim of internal analysis and VRIO is to identify both your strengths and weaknesses so that you can establish a development plan to reduce your liability of foreignness, should you decide to internationalise. In other words, it provides a gap analysis.

Provide a brief concluding summary of the key insights. Specifically:

- What are your key resources and capabilities that could provide competitive advantage in the host country (if any)?

- Can your resources and capabilities help you to exploit the market gaps you identified in the competitor analysis?

- What areas do you need to work on?

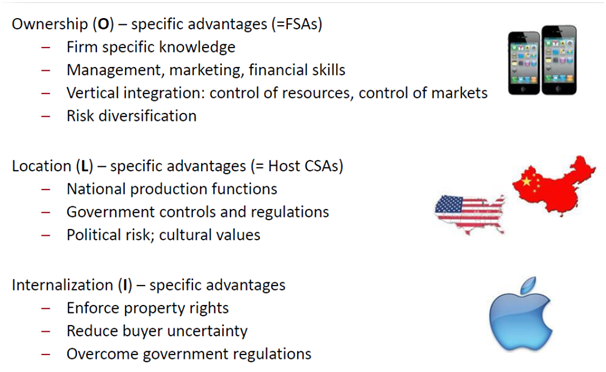

2.5 – Entry mode analysis

Now that you’ve analysed the attractiveness of the host country and your ability to compete therein, the final step is to assess potential entry modes, if you were to enter.

For this, you can use Dunning’s (1979) OLI framework as a decision path tool to make an argument regarding suitable entry mode(s). Essentially, you will work through the decision path to arrive at the most suitable option. Specifically, you will be asking the following:

- O – does the firm have the ability to provide an attractive offering in the host country (can it fill a current gap in the market)?

- L – is there a genuine benefit to having a physical presence in that country (as opposed to just selling from the home country?

- I – if you were to have a physical presence, is there a need for you to control/own it (as opposed to having another party do it on your behalf)?

The slide below provides a good overview of what you need to cover in each section:

Work through this discussion and draw a conclusion about the potential entry modes, if you were to enter. If you land up with FDI (quite likely), you can explore shared (JV, partial acquisition) and full (greenfields, full acquisition) ownership options.

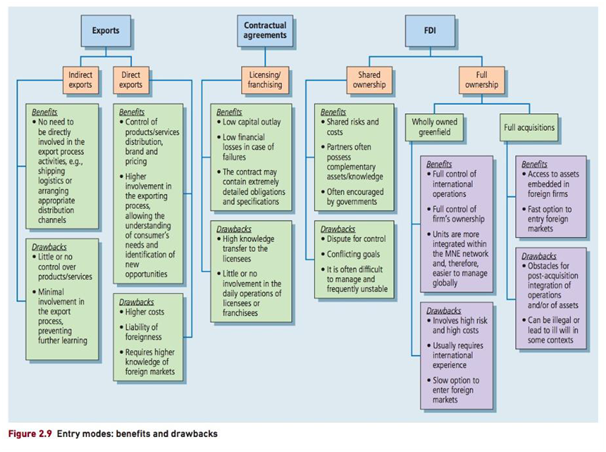

Importantly, you need to use the module theory to strengthen your arguments here. Figure 2.9 from the textbook (below) provides some good points that you can use to argue the pros and cons of different entry modes.

Conclude with a brief closing summary paragraph to wrap up the section.

Chapter 3: Integrated summary and options (1500 – 1800 words):

Now that you’ve analysed all four aspects of the IB environment, you should have a good view of the overall attractiveness of Country X and your ability to compete therein. It is now time to provide a summary of the key insights from your analysis, which will then form the basis for the proposed options.

3.1 Integrated summary

Make sure you address the following:

- Is the country seemingly attractive from an institutional view (PESTLE & CAGE)?

- Is the country’s domestic market (pool of buyers) attractive (size and value)?

- Is this market likely to be receptive (i.e. there is demand for your specific offering, and the market can afford it)?

- Is the competitive environment attractive (i.e. it’s not overly competitive – P5F and competitor analysis)? Are there gaps in the market that are ripe for picking?

- What are the critical challenges and key contributors to liability of foreignness overall?

- Does your firm have what it takes in terms of resources to overcome these liabilities?

- Can your firm provide a valuable, well-differentiated offering (i.e. something that exploits existing market gaps)? If not, which areas does it need to develop?

Essentially, your summary should cover:

- Country attractiveness (CSAs) – key attractors and detractors/risks/challenges

- Market attractiveness and receptiveness

- Firm capabilities (FSAs) – strengths and weaknesses

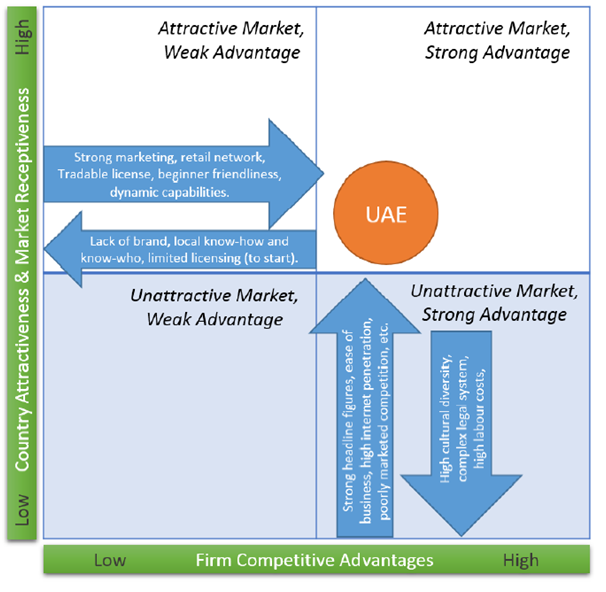

This summary should provide a clear basis for you to plot country attractiveness and market receptiveness (CAMR) against the firm’s competitive advantages / resources (FCAs) using Kinross’ CAMR-FCA matrix, as per the example below. Therefore, it would make sense to structure your summary into three sections, using the three points above as headings (CA, MR & FCAs):

3.2 Solution options

Based on this, you can present your potential response options. These might involve staying at home (not internationalising – just focusing on the home front), or internationalising using different entry modes.

- Option 1: Do nothing – stay as is.

- Option 2: Internationalise using entry mode 1 (e.g. FDI greenfield).

- Option 3: Internationalise using entry mode 2 (e.g. JV).

For each option, discuss the benefits, drawbacks and implications (a paragraph or two each). Be critical about each option – no solution is perfect.

Chapter 4: Recommendation (500 – 600 words):

In this chapter, you need to make your recommendations (regarding where and how), as well as discuss the implications thereof.

4.1 – Recommendation

Flowing from the options presented in Section 3,2, select one option, with a clear argument as to why it is the “winner”. Make it clear why it is better than the other options, and how it solves the issue discussed in the introduction chapter (i.e. the motivation for internationalisation – push and pull factors).

4.2 – Implications

Next, you need to briefly discuss the implications of your suggestion(s) – in other words:

- How well do the recommendations fit with the existing strategy of the firm (which you should have touched on within the intro)?

- Are there tensions that need to be resolved/managed?

- Does the approach align with the business’ broader objectives?

- What does the firm need to do next? Discuss 3 practical “next steps”. Typically, these are things like securing stakeholder buy-in, securing resources (financial, talent, etc), and plugging any gaps you identified in your internal analysis.

- If you’re going the FDI route, you could also briefly consider the integration-responsiveness challenge (as per Bartlett and Ghoshal’s framework) – how would you go about striking a balance in this respect?

- Lastly, you should briefly discuss the assumptions and weaknesses of your research.

- What weaknesses exist in your analysis? (for example, you might not have had enough data for a section and had to make assumptions which need to be verified)

- What should be done about that before major investment is made? For example, is further research required for a specific analysis section?

Assignments Question & Answers for University Students. Looking for Plagiarism free Answers for your college/ university Assignments. BUY NOW

For REF..#2001273