Report Assessment Questions on Workshop Manager

Assignment Detail:-

- Number of Words: 2500

Required:

You should write a report for the workshop manager which should be aimed at answering the questions raised in each part. The report should be of maximum of 2500 words (+/- 10 % allowance) comprising 1000 words for Sections A and B together and 1500 words for Section C. The section specific questions have been listed below:

Part A

Every local authority owns and operates a large pool of vehicles whose maintenance is an important support function in the local government. In one of the county councils, there is a mechanical workshop responsible for maintaining the council’s vehicles. In addition to regular check-up and maintenance services, the workshop also provides short classes to city employees on how to efficiently operate cars and trucks.

The goal of the workshop is to keep the vehicles in roadworthy condition round the clock, but breakdowns do happen. When they happen, a diagnostic check-up is performed to find out the possible cause. The workshop director, Edward Smith, has five employees and a budget of £845,000 this year.

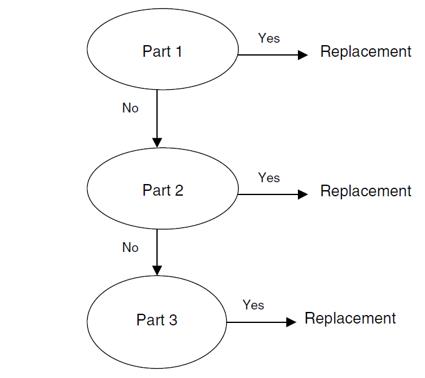

The current diagnostic system was purchased five years ago. It is a manual tester, called Vehicle Testing Programme (VTP). It includes a communicator that connects a vehicle with a computer screen. A vehicle consists of several major systems (engine, electric circuit system, fuel system, and steering system, etc.). Each system also has accessory parts. If one part breaks, the whole system fails to work. To find out the problem part, a mechanic needs to connect the VTP with the vehicle system. If a system consists of several parts, VTP has to check these parts one by one until the problem part is identified. Figure 1 shows a diagnostic process for a system that has three accessory parts.

Fig 1: Diagnostic process in VTP

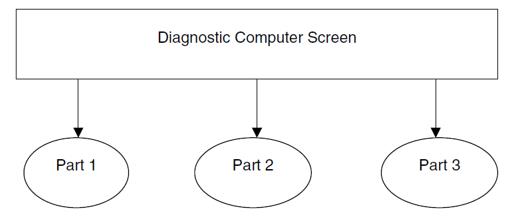

Edward believes that VTP is slow in diagnosis and yields a high possibility of replacing good parts. In this year’s budget request, Edward has requested a new diagnostic system, Quality Test System (or QTS) which comprises an information database, test instrument module, and expert diagnostic software system. During a diagnosis, a mechanic first enters a vehicle’s identification code. After analyzing the meter readouts and problem symptoms, the expert system identifies the problem part and then gives repair instructions, shown on a computer monitor. So, instead of a step-by step diagnosis for each part at a time by VTP, QTS checks all parts of a system simultaneously. Figure 2 shows how it works for a system that has three parts.

Fig 2: Diagnostic process in QTS

In a recent budget preparation meeting, Edward presented his case to the Director of his department, Lorraine Jones. He estimated that the price of QTS was £21,400 while the estimated operating cost was £280 each year. The estimated life of the system was six years (including the current year).

He estimated that the benefits of QTS would come from two sources.

First, diagnosis would be quicker, so diagnostic time would be saved. Diagnostic time is the time from the beginning of a diagnosis to the discovery of problem. The VTP’s multiple-step diagnostic process would be replaced by a single-step process of QTS. Time saving for each diagnosis problem would differ. For instance, it takes VTP 45 to 60 minutes to test an infected flow, compared to 3 minutes by QTS. For most engine problems, VTP needs 60 to 120 minutes, compared to 10 minutes by QTS. Steven estimated that, on average for each diagnosis, VTP would take 150 minutes, while QTS would take about 30.

The council has ninety vehicles: thirty police cars and sixty trucks. All the vehicles are in relatively good shape. The police cars are replaced every two years. Only a small number of vehicles need diagnosis. The mechanic workshop in the department does fifty-two diagnoses a year (once a week for fifty-two weeks a year). Also, on average, a mechanic’s hourly wage and benefits are £12.

The second major benefit comes from accurate diagnosis. QTS is more accurate than VTP in diagnosis. With VTP, mechanics are more likely to mistakenly replace a good part. This is called ineffective replacement. With the new system, the problem part could be identified accurately. Cost for ineffective replacement is £50 a diagnosis for VTP. This cost for QTS would be £0. Finally, Steven said, “if we get QTS, we can sell VTP for about £692 in today’s market.”

Lorraine is not fully convinced if the change of testing system was a good proposal and has asked Edward to fully quantify benefits and costs relevant to the proposed change and then submit a case on the basis of a proper cost benefit analysis.

Edward has discussed the proposal with the finance director who believes that if the project is approved, the funding will come from a capital project fund that is funded by council debts. The council now pays an approximate 10 percent interest rate for issuing long-term debts.

Edward is keen on the project and is of the view that key assumptions are based on the past data and are likely to change making the financial results better than what at the present are. Edward needs guidance on answering his queries and arriving at a decision.

1) Identify all relevant costs and benefits and quantify them so that a proper cost benefit analysis can be carried out.

2) Using NPV method carry out cost benefit analysis and interpret the result in your report.

[Note in the example used for CBA it has been assumed that all payments and incomes are done at the beginning of the year and hence cashflows for first year appear in year 0 i.e beginning of year 1. Normally we assume that payments and income happen at the end of the year unless expressly stated that payments are made now i.e year 0.]

3) In case the NPV method suggests that the project is not financially viable what changes in assumptions will be necessary to make the project acceptable? Alternatively, if the project is found to be financially viable, what changes in assumptions can render the project not feasible? Discuss them in your report.

Part B

The workshop has recently been approached by a “vehicles servicing company” which is a publicly listed firm, for the possibility of a strategic partnership. The following information has been made available to Edward by the company’s representative:

- The company has spent £1.50 million over the last four years on developing a new vehicle testing service.

- The firm commissioned a report costing £250,000 from an independent market research firm which suggests that demand for the service among public sector organisations will be strong. It has been reported that under normal economic conditions the contribution (net cash flows) from sales will be £8.10 million in 2022 and will grow at a rate of 15% per year for five years i.e until the end of 2026 when the service will be withdrawn. The service will also create new overhead of £1.50 million in 2022 which will increase at 4% per year until service provision is ended.

- If the proposed project goes ahead, the firm will have to invest £23.50 million in new plant and machinery and £5.60 million extra working capital will be required now i.e in 2021. The plant and machinery will be sold for £4.50 million at the end of the project in 2026.

- The firm pays corporation tax at the rate of 33% on its taxable profits which is paid one year in arrears. (Assume net cash flow is the same as taxable profits).

- A recent report by financial consultants suggests that the firm’s equity has a beta of 1.3 and reported that medium term UK government bonds are earning 3.10% per annum. In addition, the report noted that the FTSE All-share index increased by an average of 12.1% compound in each of the last three years.

- The company’s ordinary shares are trading on the stock exchange at £1.3 whilst their loan stock is trading at £99.5

- The representative made available financial statements of the company as well and inspection of the firms balance sheet reveals the following:

| Long term liabilities | £000 | ||

| 10% Loan Stock 2028 | 5,000 | ||

| (8 years remaining) | |||

| Shares & reserves: | |||

| Ordinary shares par value £1 | 13500 | ||

| Profit and loss account | 10,230 | ||

| Shareholders funds | 23730 | ||

The market research report suggests that there is a 0.55 probability of normal economic conditions prevailing over the duration of the project. However, there is a 0.25 probability that economic conditions will be poor in which case net after tax cash flows will be 30% lower than under normal conditions. On the other hand, there is a 0.2 probability that economic conditions will be good in which case net after tax cash flows will be 30% higher than under normal conditions.

The workshop management is unsure whether to consider the proposal of strategic partnership seriously or not. It has therefore asked the financial director of the council to consider financial viability of the proposed strategic partnership.

1) Work out cost of capital for the company using WACC method.

2) Work out financial feasibility of the project for the company using ENPV method.

3) What financial and non financial factors would be important if the proposal of strategic partnership is considered by the local authority. Discuss them in your report.

4) Critically evaluating the method used for evaluating investment proposals in parts a and b, highlight limitations of the investment appraisal in your report.

Part C

The workshop manager has been asked to come up with a performance report on monthly basis. He is considering using ratios for reporting organisational performance. A friend has warned him of dysfunctional consequences of performance management and planning. He has asked you to brief him on the pros and cons of using ratios analysis and how organisations may try to tackle dysfunctional consequences of performance management.

1) Briefly discuss merits and demerits of using ratios analysis

2) Provide examples of dysfunctional consequences of using performance management, contrasting with any private sector initiatives. You may also consider relevant guidance provided in corporate governance codes. Please adopt a critical approach with suggestions for any improvements.

You should confine your research to the content which is in the public domain and should avoid any activity which may require university’s ethics approval.

Do you seek Assessment Answers Online for HBS Coursework? We have a great team of experienced writers who provides you the Coursework Help at a cost-effective price. Assignmenttask.com covers all the related topics within the given deadline. Our highly Qualified Assignment Expert guides the students with their flawless content writing.