Literature Review

In this blog our professional literature review assignment writers will teach you on how to write a professional and qualified literature review paper for your dissertations writing.

- Introduction

It is often said in business circles that change is the only constant and this is certainly true in Capital Credit Union. As a small, but growing, business the Board of Directors is constantly reviewing the direction of the organisation and the introduction of the CUCA could be the biggest strategic development and change in delivery of services, since the inception of the company.

The literature review undertakes to look at the banking sector in the UK in the widest possible sense. It looks particularly at the sector from the perspective of some of the key stakeholders i.e. banks and government, as well as Capital Credit Union. For the benefit of Capital Credit Union the review looks at the research gaps, internally through the use of PEST and SWOT Analysis, the results of which will be presented later in this chapter. The literature review also views the sector from three distinct perspectives relative to Capital Credit Union, i.e.

- Customer Relations

- Customer Service

- Financial Inclusion

The British Bankers Association (BBA) is the leading UK banking and financial services trade association. The BBA represents 253 members and associate members in banking and states that “collectively all its members around the world provide a full range of banking and financial services totalling over 130 million personal accounts and contribute £35bn to the economy”. The membership of the BBA is principally the British Banking community, but not exclusively. It estimates that each banked person in the UK holds 1.5 current accounts.

In 2000 HM Treasury Department published the Cruickshank report, which had been commissioned by the Chancellor of the Exchequer to review “Competition in UK Banking”. “The report concluded that Banks [in the UK] operate on a huge scale at the heart of the modern economy. Scale is often hard to grasp. To give an illustration, in 1998, three UK banks each made more profit than the UK’s five major publicly traded supermarket companies added together. The top 10 banks together made 10 times the profit of all these supermarkets, and are, collectively, worth £200 billion. However, it is the banks’ control of the money transmission systems – cash, cheques, cards, electronic payments – that makes their innovation and efficiency crucial to the UK economy as it competes in an e- commerce world. It is this feature of banks, more than anything else that is the focus of the Review.” In 2006 one bank, the Royal Bank of Scotland, announced profits of £9 billion alone!

The financial services sector in the UK today is arguably the most profitable, with the banking sector making up a large percentage of the sector. However, perhaps as a result of the attention that the banking sector is receiving in relation to its profitability, the British Government has started to question the level of charges that high street banks are imposing on their customers. In March 2007, the Office of Fair Trading announced its plans to hold an in-depth enquiry into the charges being imposed by banks on customers.

John Fingleton, CEO of OFT stated in March 2007 “A quick-fix solution is not the answer as this might be of limited long-term benefit and could have unintended and far-reaching consequences across the whole sector and on consumers as a whole. We will look forward to co-operation from the banking sector in reaching a conclusion to this matter which is satisfactory to consumers and which will strengthen competition, efficiency and customer outcomes in the UK retail banking sector”.

Since the announcement by the OFT, there has been a swell of customers demanding a refund of charges on the basis that the level of charge in the first instance was not legal. This situation is no doubt set to run for a considerable period of time before a resolution is found. The nine credit unions offering the CUCA have already agreed to cap charges at cost plus a small administration fee, if appropriate.

- Research Gaps

There is a great deal of literature written about the financial services sector in Britain, but surprisingly little written about either the benefits of current accounts or how much profitability current accounts add to the banking sector business portfolio. This information, of course, could be classed as commercially sensitive and therefore lack of available information and statistics is perhaps not wholly unexpected.

In an effort to understand how much value current accounts could add to the profitability and relationship between bank and customer, the author of this dissertation wrote to the ten largest banks operating in Scotland/UK requesting information about the number of current accounts held by the bank, asking whether current accounts are profitable for the bank or are they a cost, as well as information about any policies the bank might have on helping people that are financially excluded. It was made explicit that the information was being requested for educational research purposes only. One bank replied stating they did not give out information for educational research purposes due to the large number of requests received annually. The other nine banks had not responded by the completion of the dissertation in June 2007.

Further searches through the Internet, particularly the top five high street banks, Government websites such as National Statistics Online, the Financial Services Authority and the Scottish Executive did not produce much more than general statistics about the economy, and nothing significant about the banking sector in relation to current accounts/transactional banking and their value in terms of profitability. Letters to the Bank of England and HM Treasury Department and their respective websites did not result in access being offered to the information requested.

There is, however, an abundance of journals and research that has been undertaken into specific parts of the banking/financial services industry in the UK and abroad. The author, in reviewing these articles, concentrated on three particular areas that are deemed to be closest in fit to providing a range of solutions to the research question:

- Customer Relationships

- Customer Service

- Financial Inclusion

- Customer Relationships

Much has been written by the academic community about relationship building and whether or not nurturing relationships with customers ultimately leads to enhanced profitability.

A paper produced by Gondat-Larralde and Neir (2003) on behalf of the Bank of England in 2003 concluded that “Bank current accounts play a pivotal role in the relationship between a bank and its customers: current accounts offer access to deposit-holding services (and potential access to savings services), money transmission through cheques and debit facilities and potentially act as a vehicle for credit through overdrafts. As such, they are key vehicles for building relationships between a bank and its customers and may serve as a gateway through which suppliers can cross-sell other banking products (e.g. savings products)”.

If the statement above by Gondat-Larralde and Neir holds true, then developing the CUCA as the platform for building a deeper relationship with members should ultimately lead to providing a greater range of products and services off the back of this product (cross selling) – leading to more member satisfaction and ultimately more profitability for the Credit Union?

Traditionally banks enjoyed a long term relationship with families, as customers would often have bank accounts opened for them by their parents and they in turn would open an account for their children.

However, in 2004, the Banking Ombudsman has argued that “the traditional personal relationship between the bank manager (or other experienced bank official) and the customer has largely disappeared”. This, it might be argued, is still the case today, and is due to the strategy adopted by banks on a number of fronts in recent years i.e.-

- Centralising decision making – thereby removing the traditional bank manager with decision making powers;

- Closing down high street branches and moving to call centres abroad;

- Internet banking.

It might also be argued that the adoption of this strategy is distancing the bank from its customers and thereby removing the ability to create and develop a relationship with customers that will lead to longer term loyalty. This situation is supported somewhat by recent advertising from the Royal Bank of Scotland and Lloyds TSB who are now putting branches back into high streets from which they had previously withdrawn. The Royal Bank of Scotland quotes 650 high street branches in Britain in 2007 compared to less that 500 in 2005.

Stewart (1998) states that “managing customer relationships needs to be done intelligently. Banks must build the capacity to understand customer relationships in the new order”. Stewart further stated that there was a gap in literature available in relation to customer defection or customer exit. In 2007 it has never been easier to move a current account from one bank to another. Indeed, the public is actively encouraged by banks to switch to a different provider and in some instances is rewarded through monetary rewards.

Understanding customer defection will be important for Capital in the early days of its current account development. In order to make it attractive for people to “switch” accounts, the credit union needs to understand more about how relationships might break down with the customers’ existing banking provider, and more importantly, learn about how to ensure that the relationship with Capital is maintained.

Reichheld and Sasser (1990) provided the original research, which spanned several different industries, on how customer retention translated into increased profits. Rust & Zahorick (1993) were the first to identify the financial implications and effect on profitability of customer retention in the retail banking environment.

Customer relationship is a concept of the marketing industry, and as a phenomenon in the modern business world Webster (1992) and Berry (1983) “view relationship marketing as a strategy to attract, maintain and enhance customer relationships”. Rapp and Collins (1990) argued that “goals of relationship marketing are to create and maintain lasting relationships between the firm and its customers that are rewarding for both sides”.

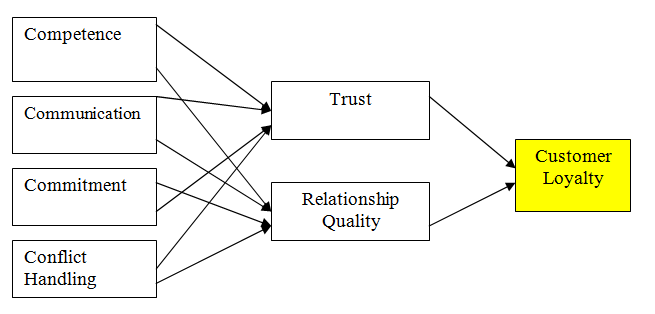

Ndubisi N, Wah and Ndubisi G (2007) developed a framework for building meaningful customer relationships as highlighted below in Figure 5. They stated that relationships “are theorized and that competence, commitment and conflict handlings, will directly influence trust and relationship quality and indirectly influence customer loyalty”. Capital Credit Union already understands that these factors influence customer behaviour and it develops policies to ensure that members are confident about how they will be treated when they purchase products and services. Building trust and developing a quality relationship is paramount to customer loyalty.

Figure 5 Research Frame-work for Building Customer

Relations – Ndubisi 2003

- Customer Service

According to Yavas et al (1998) “service quality is at the root of customer satisfaction and is linked to such behavioural outcomes as word of mouth, complaints, recommending and switching”.

There is much empirical research and previous studies which have documented the effect of customer service on customer retention and loyalty (Rust and Zahorik, 1993), (Bloemer et al, 1998; Oliver, 1999, Jones and Farquhar, 2003). All of these studies have brought forward arguments supporting the importance of customer service and its importance in relation to customer retention.

Capital Credit Union is not a “Universal Bank” as described by Revell, (1991), although it is now in a position to carry a full range of banking services through multiple distribution channels, some of which are unique in financial services. Some of these distribution channels include: a head office, telephone, internet, royal mail, and shared branches through sponsoring employer outlets, and like minded partner organizations such as the CAB, amongst others.

The distribution channels and range of products are important factors in increasing the market coverage (Chandler et al., (1984)), but customer service, resulting in customer loyalty, is equally important.

If building customer relationships is paramount to improving profitability, then customer satisfaction and quality service is paramount to building the customer relationship. In 18 years, and numerous member surveys, the primary reason that members join the credit union is cited as being personal recommendation.

Members trust other members. The power of word of mouth has been proven in Capital Credit Union time after time.

According to GFK Financial “Financial Research Survey (FRS) shows that a quarter of those taking out a current account, or switching brand, cite recommendation as a reason for brand choice”. This figure has been rising, and continues to rise, year on year.

Figure 6 Sources of Customer Trust

WHAT SOURCES DO CUSTOMERS TRUST?

PEOPLE

| EDITORIAL ADVERTISING ONLINE / INTERNET SOURCE | ||||||||

| %age | 0 | 10 | 20 | 30 | 40 | 50 | 60 | 70 |

Source RRW UK 2006

Good customer service leads to customer loyalty, which in turn leads to members telling others about the credit union. Members are at the centre of every policy and every action and staff understand, through training and development, that the provision of quality services and products is paramount to the future success of the business.

- Financial Inclusion

Since the mid-1990s much has been written about financial inclusion in Britain. Partly as a result of government concerns about the financial services markets failing many Britons, there have been a number of publications and studies noting the continuing withdrawal of financial services and products to those with least wealth including Joseph Rowntree Foundation 1999, Financial Services Authority 2000 & 2006, Social Exclusion Unit 2001, HM Treasury 1999 & 2004, and Department of Social Security 2001.

As a result of the government Spending Review 2004, HM Treasury produced “Promoting Financial Exclusion 2004”, a document which denotes the key components of financial exclusion as follows:

Figure 7 – Financial Exclusion as defined by HM Treasury 2004

Stephen Timms, Financial Secretary, launched a Financial Inclusion Task Force (2004) to help develop Government policy to tackle financial exclusion. Mr Timms said “We know that there are around

- million adults in households with no access to a bank account. The Government and the banks have agreed to work together towards the goal of halfing this number and this new taskforce will have a key role in monitoring progress. The Taskforce will also advise the Government about what more needs to be done to tackle financial exclusion. We need to work together to enable individuals to take control of their own finances and access the financial services they need.”

The result of the Financial Inclusion Task Force in 2005 was to recommend that government consider further policy and commit additional funds to assisting voluntary, statutory and commercial organisations to deliver what is now known as the ABC:

- Money ADVICE and financial education

- Access to BANKING services for all

- Low cost affordable CREDIT for everyone

In 2007, despite significant government funding, many people, particularly those living on low incomes, still cannot access mainstream financial products such as bank accounts and low cost loans (HM Treasury 2007, Citizens Advice Bureau 2007). As a result, financial exclusion continues to impose additional costs on individuals and their families – people who are often the most vulnerable in our society. Financial exclusion also affects communities and their ability to grow as a result of the withdrawal of reliable, accessible and affordable financial services. This is despite the UK having one of the most diverse financial services sectors in the world (HM Treasury 2007).

In 2007, Capital Credit Union was awarded the largest government contract in Scotland by the Department of Work and Pensions to provide low cost loans to people that fell into the DWP criteria as being financially excluded. Total personal debt in Scotland is estimated to be in the region of £14.7 billion, with over 30,000 Scots in severe financial difficulties. Recent legislation by the Scottish Parliament has also considerably diluted bankruptcy legislation and in particular, legislation relating to Trust Deeds. Scots can now walk away from debt 12 months after signing a Trust Deed.

- Review of Capital through PEST and SWOT Analysis

Capital uses a number of tools to help identify issues that may have an impact on the strategic direction of the Credit Union, including PEST analysis and SWOT analysis. Both of these tools are widely used by Capital and have been developed further specifically for the purposes of this dissertation and to help gain an overview of the organisation at this time.

PEST analysis is sometimes described as “big picture analysis” as it is used to determine factors relating to the Political, Economic, Social and Technological environment within which organisations operate.

PEST analysis has been used in this dissertation to determine the factors in the external (macro) environment that may or may not have an impact on the success of the delivery of the Credit Union Current Account. Factors identified through the use of this type of analysis are usually, but not exclusively, outwith the control of the organisation. PEST analysis is also a valuable tool to help an organisation understand market growth and potential direction for the organisation due to these external factors.

SWOT analysis provides a simple framework to help analyse the strategic options from a situational analysis. A SWOT analysis of Capital has been used to determine the internal strengths and weaknesses of the organisation, as well as the external opportunities and threats. The aim of the SWOT is to help identify the key factors that are consistent with the overall corporate objectives.

Johnson & Scholes (Exploring Corporate Strategy) state:

“A SWOT analysis summarises the key issues from an analysis of the business environment and the strategic capabilities of an organisation”.

PEST Analysis for Capital Credit Union

The following table details the PEST analysis carried out on Capital Credit Union, with particular emphasis on the issues that may relate to the delivery of a Credit Union Current Account:

Political

- Labour Government Policy on financial exclusion – significant investment in tackling financial exclusion set to continue under Gordon Brown as British Prime Minister.

- Scottish Executive Policy on credit unions. Credit Unions identified as part of solution to tackle asset accumulation, unbanked, volunteer development. Funding continues to be available in 2007/2008 for new initiatives to tackle problem.

- Local Government support of Scottish Credit Unions, funding, premises, sponsoring employer status (all local authorities in Capital’s common bond support the credit union as a sponsoring employer).

- Change of Government in either London or Scotland could have serious impact on CU support nationally.

Economic

- Rising interest rates squeezing margins and profitability for all financial services providers.

- European Union fiscal policies complicate British legislation in relation to Credit Unions and current exemptions. Credit Unions in Europe are currently unique to Britain and Ireland. (CUs in Poland, but with different legal structures – WOCCU).

- Poor returns on equities market in recent years have made credit union returns more competitive and attractive.

- Savings mobilisation – spend culture – little thought to future needs.

- Mutual organisation – “no fat cats” – one member one vote regardless of shares/savings.

Social

- Democratic organisation.

- Attraction to organisation taking ethical stance (e.g. Co-operative Bank).

- Volunteers’ accessibility to educational and networking opportunities to further own abilities/career.

- Co-operative values.

- Education for members on managing finances.

- Access to running a business for key volunteers.

- Uniqueness of common bond concept in financial services market.

Technological

- Offers huge opportunities to develop services using existing technology – cost limiting factor.

- Expectation of mainstream population for services to be delivered via technology e.g. website/ATM network.

- New players in CU technology market offering more opportunities to access more cost effectively.

SWOT Analysis on Capital Credit Union

Ralph Stacey (2004) refers to SWOT analysis as follows:

“Managers should analyse their organisation’s strengths, weaknesses, and opportunities. They should then use the analysis to guide actions that build on strengths, secure opportunities consistent with those strengths and avoid threats and activities where they are weak”.

The following table helps to identify those strengths, weaknesses and opportunities, as well as those activities that are a threat and should be avoided, according to Stacey.

Figure 8 – SWOT Analysis – Capital Credit Union

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

- Summary

In summary, the delivery of financial services is clearly a profitable marketplace in Britain. However, this literature review shows that in order to continue to be profitable, the Credit Union will need to make some significant strategic decisions about the delivery of services to its members.

Research shows that recruitment and retention go hand in hand and that Capital will need to develop a strategy for attracting new members, and if the CUCA is the platform to do this, how will it happen? Retention of members is of paramount importance; not least the costs involved in attracting new members, but the profitability of “selling” more products and services and gaining a larger proportion of members’ financial business, will ultimately lead to more profitability.

Building a successful relationship and the provision of good customer services are key to the future success of the Credit Union. This in turn should create loyalty and encourage members to tell others.

However, the product and services will also require to be competitive and charges may be a factor that the Credit Union needs to look at in more detail.

Caution will be required, however, in any additional undertakings in the financially excluded market as research also shows that this market carries the highest risks of debt default. Capital Credit Union has already committed significantly to the delivery of quality, affordable financial services to those people with fewer choices. The Board will need to ensure that it fully understands the implications of its decisions if it continues to work in this part of the market. The credit union financial inclusion agenda is both a threat and an opportunity!