Capital’s Approach to Strategy

Why is corporate and business strategy analysis important? Because it allows businesses to examine how they are performing and what systems are in place to keep them sustainable. A good marketing strategy consolidates what you know about how your business fits into the market — create a killer strategy for your home biz.

Capital’s Approach to Strategy

- Strategic Approaches

There are many approaches and techniques that have been developed over the years to assist organisations in the development of strategy, several of which have been utilised by Capital Credit Union.

Johnson & Scholes (Exploring Corporate Strategy) 2002 describe the characteristics of strategic decision making as:

- Strategic Developments are likely to be concerned with or affect the long term direction of the organisation.

- Strategic Developments are normally about trying to achieve some advantage for the organisation.

- Strategic Developments are likely to be concerned with the scope of the organisation’s activities.

- Strategy can be seen as matching the activities of an organisation to the environment in which it operates.

Some of the more common approaches to strategy are:

- The Rational Planning Model

- The Logical Instrumentalism Model – includes Mint berg’s Emergent Strategy Model

- Scenario Planning

Capital tends to adopt the Rational Planning Model (Friedmann 1987) for setting strategy, which involves setting objectives, analysing the environment and resources of the organisation and from the analysis, generating strategic objectives. Implementation and control processes and monitoring follows. In the main, the approach has worked well and the credit union has developed and followed a strategic plan that has seen the organisation grow to become the third largest credit union in Scotland.

There are, however, criticisms of this approach, not least that it does not reach wide enough and can exclude dimensions such as cultural and political aspects, also that it can become too detailed and make too much use of historical data to be effective in developing the future of the organisation. The ownership of the strategy in this approach is also called into question as it appears to be very much “top-down” strategic management and therefore harder for more junior levels of staff to understand or adopt ownership of the part they play in the future of the organisation. There is some criticism that the approach does not lend itself to involving staff at all levels in the organisation and, as a consequence, the Strategic Plan may invariably “end up on a shelf gathering dust”.

- Techniques for Analysing the Environment

As well as the different approaches to strategy as highlighted above, there are also a number of techniques that have been developed over the years to assist organisations in the development of strategy. Some of the better known techniques are:

- Porter’s 5 forces – Developed by Michael Porter (1980), the Five Forces Model is used to develop industry analysis, which distinguishes the five forces that govern

Capital Credit Union makes significant use of this model and the model has been developed further, as at Appendix 1, for purposes of this research.

PEST (Political, Economic, Social and Technological) is used to examine the wider external factors, as well as the key stakeholders of the organisation, in an effort to identify issues and risks, as well as help in the development of strategic solutions. PEST analysis is used widely by Capital as part of its planning process as can be seen in Chapter 4.

There are also techniques that help Senior Managers identify the internal factors that may have an impact on the future of the organisation. These techniques include:

- SWOT (strengths, weaknesses, opportunities and threats). SWOT looks at the internal strengths and weaknesses of the organisation and the external opportunities and threats. A SWOT Analysis is shown in Chapter 4 and which has been carried out for the purposes of this

- Value Chain Analysis (Porter 1985) – the value chain breaks down the organisation into its strategically relevant components and helps to identify where the value, costs and weaknesses The value chain analysis shows how and where the organisation creates value for its customers.

- Capital Credit Union’s Strategic Approach

Capital has a relatively well developed method of setting strategy which, could be argued, most closely resembles the Rational Planning approach as outlined in Figure 2. The Board of Directors and the Senior Management Team annually set aside two days for a strategic planning seminar. The strategic planning seminar is facilitated by an external consultant. The role of the consultant is to help the Board and Senior Management Team in the development of the strategy at corporate, business and operational levels.

Figure 2 – Rational Approach to Setting Strategy as adopted by Capital

Setting Goals & Objectives >>> Analysing the internal and external environment & resources available >>> Generating strategic options & appraising them >>> Planning & implementation (includes operationalising objectives) >>> Monitoring & assessment of plans – revising when necessary

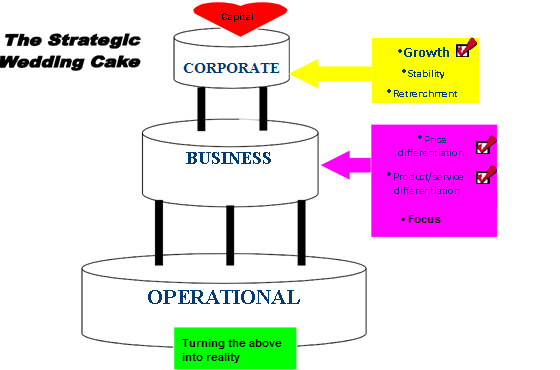

Capital identifies three levels of strategy that are developed in order to try and gain competitive advantage in the financial services market in Lothian and the Scottish Borders. The Credit Union develops Corporate, Business and Operational Strategy and it uses a number of already available tools to help it develop its strategic aims and objectives and compete in its chosen market place.

The Corporate Strategy considers the organisation as a whole and is concerned with the highest level of objectives i.e. growth, stability or retrenchment. The Business Strategy looks specifically at how the Credit Union will compete e.g. will it compete on price (cost leadership, Porter 1985), or product/service differentiation, or by focussing on a particular part of the market. The Operational Strategy is concerned with the delivery of the corporate and business strategies.

Figure 3 – Strategic Wedding Cake as developed by Capital

- Capital Credit Union Corporate Strategy

The Board of Capital recognises that, in order to continue to provide quality products and excellent services to members, the organisation needs to grow. The growth strategy that has been agreed by the Board of Directors has not been adopted for growth’s sake, but the Board recognise that the organisation needs to be in a position to generate surpluses to continue to develop existing services to meet members’ needs; otherwise members will take their business elsewhere. The Board also understands that the financial inclusion agenda that it has approved is costly and requires a higher level of investment and resources due to the higher risks associated with this market.

- Capital Credit Union Business Strategy

Through its Strategic Business Plan, the Board of Directors has already determined the following as part of the Business Strategy:

- The Credit Union will provide high quality services and develop products specifically to meet the needs of all our members.

- The Credit Union will provide access to affordable products and services for those members of society excluded from mainstream services – who are financially excluded.

- As a not for profit organisation, the Credit Union is able to maintain a low cost base due to the use of volunteers to provide strategic direction and assistance at an operational level on a daily basis.

Having already recognised that it needs to divide its market into two different segments, i.e. those members that are suffering from financial exclusion, and those members that expect mainstream financial services and products, Capital recognises that each segment will need a separate strategic approach. Given the limited size of the organisation and resources available, this will bring about some fairly major challenges for the organisation.

- Capital Credit Union Operational Strategy

The Operational Strategy is the “how?” part of the strategic implementation. It is about turning the strategic aims of the organisation into reality. The Chief Executive of Capital is responsible for the delivery of the strategic aims and this process is undertaken in liaison with the whole staff team. The staff team attends an annual planning seminar (APS) as soon as practical after the Board of Directors holds its APS. Policies, procedures and the resources needed to deliver the Corporate and Business Strategies are developed in conjunction with the senior management team.

A small number of Board members attend the staff team planning seminar to help communicate, first hand, the Board’s strategic aims for the organisation.

- Hazards of adopting a dual business strategy

Porter (2004) states that “in coping with the five competitive forces there are three potentially successful generic strategies…..sometimes the firm can successfully pursue more than one approach as its primary target, though this is rarely possible….”

Porter concludes that a firm that follows more than one generic strategy risks being “stuck in the middle”. Porter also states that a firm that is stuck in the middle is almost guaranteed low profitability.

Porter’s argument is that a firm which competes on the basis of being the lowest cost provider in the market risks “bidding away its profits”.

With regard to the business strategy adopted by Capital Credit Union, the organisation has a dual approach, i.e. on one hand the credit union aims to compete on cost for its less affluent members, whilst for its more affluent members, it aims to compete on the basis of service differentiation. This strategy has been endorsed by the Board of Directors, in order to achieve both retention of existing members and attraction of new members in all demographic segments of the target market.

In hypothetical terms, the pursuit of this dual strategy carries risks – i.e. traditionally, in order to achieve successful service differentiation, above-average expenditure would be required. This would obviously seriously dilute, or even completely destroy, the organisation’s ability to compete as a price differentiator.

However, in reality, the Board of Directors of Capital Credit Union is of the opinion that it is viable for them to pursue this dual strategy. This is as a result of the credit union having a low fixed cost base, largely due to the fact that the credit union’s operations are heavily reliant on voluntary (unpaid) support.

- Strategic Impact of New Regulations

Since 2002, credit unions have enjoyed the ability to offer many more services and products, as is highlighted in the Figure 4.

As a result of the relaxation of previously restrictive legislation, this has allowed not only Capital Credit Union, but also other credit unions, to become more innovative in the delivery of services and products. With a wider range of products available now to credit unions, it is the operational approach that can make the biggest difference. If the credit union maximises the opportunities available through the relaxation of legislation, there is more scope to attract a greater number of members, as well as provide more services and products to existing members who are already purchasing these products from other providers.

Figure 4 – Main Products and Services pre and post FSA

| Registry of Friendly Societies | Financial Services Authority |

|

|